The Why

For a long time, I’ve always only had ONE idea of what would cause the recession. It’s gone from housing, to apartments, to pensions, and back again, but now I have a LOT of predictions. That’s right: we’re in what has now come to be referred to as the Everything Bubble. Everything is a bubble right now. What’s going to pop first? Well… I’m torn… So here are my five guesses on what I think will cause the next recession!

Let me give a little background why I wrote this article. I was a Finance major, and I’ve always been obsessed with the last recession, what led us there, etc. What led us there, the aftermath, and of course, the information it gave us to hopefully predict the next one. I’ve read article after article about the recession, and I feel like there’s always more to learn.

My favorite articles to read are the ones that everyone and his or her mother has seen that says, “This guy predicted the last recession, and here’s what he has to say now.” Those blogs are incredibly misleading because the person (or economist or blogger) that usually predicted the recession predicts a recession every year. That was just the ONE year they were right. They’re permabears (aka someone who always thinks the world is ending). Keep in mind, I’m not that kind of person. If you’ve ever met me, I’m eternally optimistic and incredibly enthusiastic, BUT I do love thinking about the next recession.

So what’s one of my favorite hobbies? Yep, that’s right: trying to predict the next recession. I’m obsessed with it. I love reading finance articles, understand the Fed, and trying to make sense of the current economy and trying to catch where it will go wrong.

For a long time, I’ve always only had ONE idea of what would cause the recession. It’s gone from housing, to apartments, to pensions, and back again, but now I have a LOT of predictions. That’s right; we’re in what has now come to be referred to as the Everything Bubble. Everything is a bubble right now. What’s going to pop first? Well… I’m torn… So here are my five guesses on what I think will cause the next recession!

Housing Crisis 2.0

So first and foremost, I have to start off with the housing crisis. If 2007 and 2008 taught us anything, it’s that you CAN go wrong investing in real estate. Everyone was doing it, and then the music stopped, and it all came crashing down. There are a lot of parallels you can draw in today’s world back to the 2006-2007 world. For example, how many of your friends or family have considered getting into real estate–INVESTMENT real estate? How many times have you heard about prices in your neighborhood or surrounding area rise too fast?

And here’s the other issue. Rates are rising. While you used to be able to get a mortgage in the 3% range, that rate is steadily increasing while the Fed is raising rates. If millennials weren’t able to buy homes at THOSE low rates, then how will they be able to buy them when they’re even higher. And if millennials, and the next generation don’t start considering getting a mortgage, we could see the housing market all the sudden collapse.

But that’s all anecdotal evidence. Let’s look at the facts.

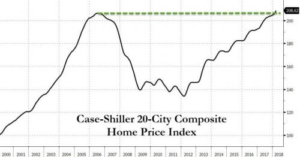

First, there’s housing prices in America. No one can argue that they’ve gone up, but look how closely they are to the last recession:

Don’t believe me, let’s take a look at the market value of all homes in this fun, colorful, and albeit frightening gif:

![]()

What does it all mean? Housing Bubble 2.0.

But it’s not enough to say there’s a bubble JUST because we’re at the same spot we were last time. There’s only a real problem if there’s a pullback and the bubble “pops.” I think there a few factors that could cause a pop in the next few years:

- Rates are rising: if rates are higher, then mortgage payments are higher. If someone can’t afford a mortgage payment, then they certainly can’t afford a higher mortgage payment thanks to rising rates. You don’t buy a house–you buy a payment. Higher rates mean higher payments. Less people buy houses, more supply on the market, prices decrease from bubble levels, underwater mortgages, etc etc etc RECESSION

- Millennials aren’t buying homes: this could go with the above one, but looking specifically at my generation, millennials aren’t buying homes. Now there’s a litany of reasons–lower wages, student debt, not wanting to make a commitment, and all that. But this is a HUGE issue. Also, more millennials are LOVING the apartment boom right now (see below). Millennials can live in luxury (much like some of them lived in the dorms at their colleges financed by student debt); they can have pools, gyms, bars–so why buy a house? And without more millennials buying homes and buying goods for their home and all that, SEE ABOVE more supply on the market, prices decrease from bubble levels, and same old same old…

It is worth noting that a few economists smarter than I am have said that the pullback in housing has already started.

Here’s some facts from David Haggith published on The Great Recession Blog:

New-home-construction starts are down 12.3% nationwide to a nine-month low due to the largest single-month drop in more than year and a half. That is a huge sign of a nationwide housing market collapse when you consider that this is the time of year when housing is usually on a tear because weather allows construction everywhere. Instead, construction in the US is down … way down … EVERYWHERE.

While that nine-month period back to the last low in construction was merely propped up by hurricane and wildfire rebuilds, as I said it would be (see articles listed below), we’ve already hit the point where those necessary rebuilds (still happening) are not strong enough to overcome the more general housing decline that is overtaking the nation and many other nations. Significant to that point, housing starts fell in all regions of the country. Both single-family and multi-family housing construction are losing momentum.

As an even clearer sign of where we are headed in the near future, housing construction permits are also down … for the third count (third month in a row). So, the decline in permits is now a trend. While single-family permits saw a small gain of 0.8% in June, multi-family permits dropped 7.6%. June had been expected by economists to bring a rebound that didn’t materialize, setting a new trend firmly in place.

Mortgage applications also fell nationwide this week. Some of which are at 9 year lows.

*Ominous music playing in the distance*

Apartment and spec office

So this one is pretty difficult to explain, and may be the one that is the least plausible, but here it goes.

First off, anecdotal evidence: how many new luxury apartments have you seen built in your city in the last few years? How many new downtown construction sites are there for new office buildings? These should come as no surprise because after all, the market is doing well. People are making more money, so perhaps they want to spend them on expensive office spaces and expensive apartments. So what’s the problem?

Well, my issue is what this is doing to millennials. Young professionals are constantly seeing that they can live in a LUXURY apartment, spending way out of their means to live there, and thus not saving for retirement (or more importantly A FRIGGIN HOUSE). Do you need a bar, workout gym, pool, or a coffee shop in your apartment? You may think so, but it’s not the case. And who’s moving into these apartments? Major cities are seeing substantial growth with new arrivees willing to pay top dollar to live in the hip part of town.

But why is this a problem? Well, I could draw it all back to the fact that millennials aren’t saving for a house, and thus, will cause a housing crisis, but I want to avoid that part for this portion. Instead, we need to look at the developers. The developers, after all, are taking huge risks on these apartments. They’re taking huge loans on a gamble–a gamble that millennials will continue to want these apartments and continue moving to these new cities. But as we learned from 08, the music can’t go on forever. And many of these investors are from out of town. Take a look at who’s building some of the apartments in your city–i’d be willing to bet that a lot of the money is coming from out of town. So what will happen when the community bank that lended to them when the investor starts defaulting and walks away? The same thing that happened in 08.

And let’s look at more risks: millennials may start moving to more rural towns after they become disenfranchised by the rising prices in major cities. After all, the WSJ reported that many small rural towns are finding ways to pay millennials to move there.

Then what else is in the hip part of town? The brand new office buildings (and don’t get me started on how horrible of an idea WeWork is). But spec office in downtown areas is not delivering. We’re seeing previously built buildings foreclosing, and that’s because the demand for these has collapsed.

The point of all of this is that developers are taking huge risks in massive ways all across the country. My question is, what happens when the demand stops, and these investors (and banks) are left with MASSIVE assets, but no one to use them?

Pension Crisis

So you’ve probably heard people talk about pensions lately. There’s some states that are doing worse than others **COUGH COUGH MY HOME STATE OF KENTUCKY COUGH COUGH** but then there’s also the federal pension crisis.

Just to give you my favorite fact: the combined pension hole for US cities and states is the size of Germany’s economy. Let that sink in… That means that these cities and states cannot POSSIBLY keep their promise to the workers of a solid pension in retirement. And that could spell horrible complications for the rest of the society–even if you don’t have a pension.

Keep in mind, here’s my opinion on pensions: a promise is a promise. If you were promised something, you should get it. But here’s the issue: we may have gotten a LITTLE carried away with those promises. CLEARLY.

Most municipalities only have one solution: raise taxes or slash benefits. There’s no other solution. And BOTH those solutions will piss a lot of people off.

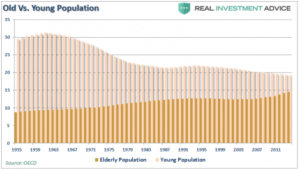

There’s a couple other factors that are causing issues. Retirees are living longer and longer, and there are starting to be not enough young workers to support them:

Another problem is predictions. We have people running pensions that are predicting outstanding growth, compounding, and great investments… but that’s clearly not the case.

“The next crisis won’t be secluded to just sub-prime auto loans, student loans, and commercial real estate. It will be fueled by the “run on pensions” when “fear” prevails benefits will be lost entirely.” – Lance Roberts from realinvestmentadvice.com

I want to end this section by PLEADING with all those on a pension to find a way to supplement it. Begin saving for your retirement through a Roth IRA, or see if your pension can blend with a self-funded 401k. Whatever it is, just be sure you’re ready in case one day, you’re told: “we’ve run dry.”

Automation

Automation is an easy one. If you haven’t watched this video, I highly suggest it (Humans Need Not Apply). It’s a 15 minute documentary that breaks down all the ways that robots could take basically ANY job in existence right now. And it’s 4 years old. In the last few years there have been major steps made in robotics, artificial intelligence, and automation. Robotic work could take over a majority of businesses in America tomorrow, and we are vastly unprepared for it. We could see unemployment rising above 25% because humans are inevitably unemployable. During the Great Depression, we had unemployment of 25% as well. If that many people are out of work, and literally unemployable compared to their robotic counterparts, what will we do? Will we see a universal basic income? Who knows. Either way, I’m just trying my best to find ways to seperate myself from our one day robotic overlords.

Tech Overinvestment

This is another easy one, and it goes back to the Everything Bubble (where everything is overpriced and about to POP). Investment in technology and startups has skyrocketed. Keep in mind, in a vacuum, this isn’t a bad thing. We have a great economy, interest rates are low (for now), so people have lots of cash and want to put it in the next big Amazon. But here’s the issue–we’re investing a lot of money in companies that are LOSING MONEY. My favorite punching bag is Tesla, and even though the government has given it $5 billion, it still can’t turn a profit. It’s burning through cash like crazy, and still investors are LINING up to give them more money.

“Uber, the highest-valued private technology company, has rapidly growing revenue but remains highly unprofitable. With revenue of $6.5 billion in 2016, it still registered a net loss of $2.8 billion.” – CNBC

And many of these companies unprofitable by design. Of course one could start a pothole company tomorrow, get a loan for the paving truck and start to grow slowly and organically without taking massive investment and growing rapidly like many companies in Silicon Valley. The world of Silicon Valley is “move fast break things,” so you have to keep up. Many companies in this atmosphere are choosing unprofitability for growth. Investment allows them to grow at an unbelievable rate.

But investments in startups are out of hand. Our society right now puts startups on some type of pedestal, when in reality, they’re not doing as well as we think.

“A recent study by the National Bureau of Economic Research concludes that, on average, unicorns are roughly 50 percent overvalued. The research, conducted by Will Gornall at the University of British Columbia and Ilya Strebulaev of Stanford, examined 135 unicorns (a start-up company valued at more than a billion dollars, typically in the software or technology sector.). Of those 135, the researchers estimate that nearly half, or 65, should be more fairly valued at less than $1 billion.”

We love shiny. And there’s a lot of shiny to choose from right now.

But how will this cause a recession? Let’s take a look at the last dotcom bubble:

Investopedia:

Many argue that the dotcom boom and bust was a case of too much too fast. Companies that couldn’t decide on their corporate creed were given millions of dollars and told to grow to Microsoft size by tomorrow. When it became clear that most companies couldn’t, much of the free cash coming from venture capitalists to take these companies public suddenly dried up. A lot of ridiculous companies went under, but so did many companies that could have been viable in the right conditions. This purge set back some technologies in Silicon Valley back decades in addition to destroying a lot of capital in failed IPOs.

Conclusion

So first off, I should probably admit that I’m an eternal optimist. The market will always have recessions, but it always rebounds. While I do have fears of the market failing, I definitely don’t know when it will happen, but I know whatever it is, we will persevere.

Secondly, no one knows when the next recession will ACTUALLY happen. I like to think I can predict WHAT will cause it, but NO ONE knows WHEN. Don’t let any of my advice keep you from investing or making any big decisions in the market. The only big mistake you can make in the market is missing out!

Finally, I would love to hear feedback on this blog. If you agree, if you disagree, please let us at Drunken Money know. You can email me at paul@drunkenmoney.com OR you can always comment on our social media. Whatever medium, I’ll try my best to get back to you! Would definitely love to hear your thoughts!